TFOA Update | April 2024

Please check your spam folder to be sure my email marc@tfoatx.com is on your safe senders list. I suspect you might find a few past emails from me there!

About TFOA

The Family Office Association (TFOA) is a global peer network that serves as the world’s leading single family office community. Our group is for education, networking, selective co-investment, and a resource for single family offices to share ideas, deal flow and best practices. Members are not actively marketing products or services to other members and no contact information or email lists will ever be shared. Since our founding in 2007, TFOA has led the global single family office community by delivering world-class educational content, unique networking opportunities, and exceptional thought leadership to our highly curated network of the world’s largest and wealthiest families. If you'd like to stay in touch on a more frequent basis, please follow us on LinkedIn and Twitter. In the meantime, please check out our free library of family office content.

How Should I Surround My Single Family Office With Advisors?

ABSTRACT: This paper examines best practices for single family offices (SFOs) in selecting and coordinating outside advisors. SFOs commonly utilize external specialists in law, accounting, investments, insurance, philanthropy, and IT to supplement in-house capabilities. A formal vetting process is recommended when choosing advisors to avoid conflicts of interest. Criteria should include safeguarding family privacy, reasonable fees, relevant expertise, responsiveness, and coordination with other advisors. Budgets help prioritize advisor needs. Performance should be frequently reviewed to ensure high-quality, tailored services. While in-house staff focus solely on the family's needs, outsourcing provides cost savings, specialized skills, economies of scale, and exposure to external best practices. Confidential, mission-critical activities warrant in-house expertise. Complex services requiring substantial infrastructure are better outsourced. Balance is required between dedicated in-house capabilities and leveraging external specialists. Formal selection and review procedures ensure advisors match SFO requirements. The paper provides best practices for SFOs to optimize their mix of in-house and outsourced advisory services.

If you would like to comment on this whitepaper please visit the following link and let us know what you think: What is a Single Family Office?

If you would like to participate in The Family Office Association's 10th Annual Single Family Office Symposium this September 10th & 11th 2024 in Dallas, TX, please consider:

- Joining TFOA – attendance in person is open to single family office principals and executives only: Membership

- Virtually Attending – open to anyone, see our website and click the Virtual Track button: Registration

- Sponsoring – open to a few select sponsors to attend in person, please email for more information: Sponsoring

We're delighted to share the following speakers have confirmed their participation:

1. Kyle Bass, Founder and Chief Investment Officer of Hayman Capital Management.

2. Paul Carbone , Co-Founder and Vice Chairman of Pritzker Private Capital.

3. John Phelan, Chairman of Rugger Management and Co-founder of MSD Partners.

- Ray Washburne, President & CEO of Charter Holdings.

Monthly Update

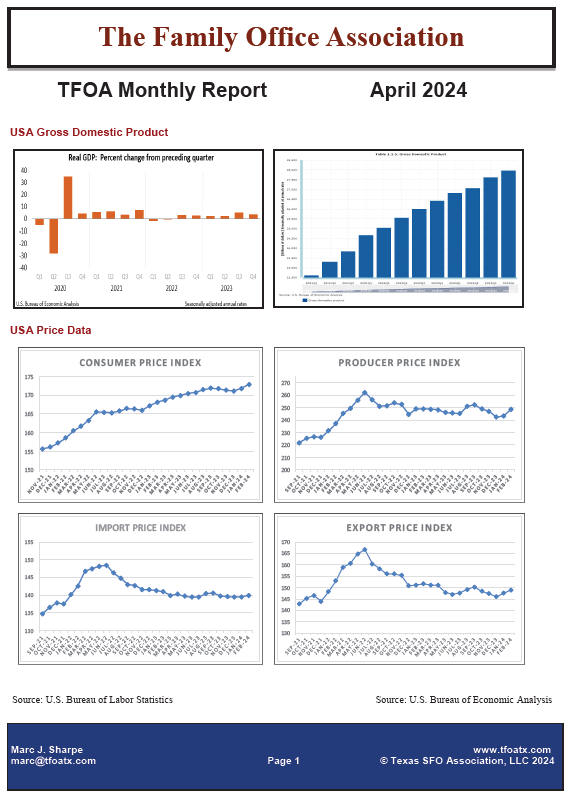

Please find below this month’s Economic Update which includes a wealth of data and exhibits on the USA economy and selected States. You will also find market returns, 10-Year expected asset class returns, private equity price and leverage multiples, GP commitment data by sector, and the current economic release calendar for your convenience. We hope you will find this report helpful.

Marc J. Sharpe is the founder and chairman of The Family Office Association (“TFOA”), a peer network of single family offices founded in 2007. In addition, he is an Operating Partner with Satori Capital, LLC, a multi-strategy investment firm founded upon the principles of conscious capitalism, a business approach that emphasizes extraordinary long-term outcomes for all stakeholders. He also teaches an MBA class on “The Entrepreneurial Family Office” as an Adjunct Professor at SMU Cox School of Business. Marc holds an M.A. from Cambridge University, a M.Phil. from Oxford University, and an MBA from Harvard Business School.

All the information provided by The Family Office Association ("TFOA") are for informational and educational purposes only and neither purports nor intends to be, specific trading or investment advice or a recommendation to buy or sell any security, fund, or financial instrument. Information should not be considered as an offer or enticement to buy, sell or trade. You should seek appropriate advice from your broker, or licensed investment advisor, before taking any action. Past performance does not guarantee future results. By subscribing as a member to TFOA, you acknowledge and accept that all trading decisions are your own sole responsibility, and TFOA or anybody associated with TFOA cannot be held responsible for any losses that are incurred as a result. The information contained in this electronic mail message, including attachments, if any, is confidential information. It is intended only for the use of the person(s) named above. Internet emails are not necessarily secure. Each recipient is responsible for carrying out such virus and other checks as it considers appropriate to ensure that the receipt, opening, use or onward transmission of this message and any attachments will not adversely affect its systems or data.