The Renaissance of Energy

Authored by Sean Maher of Third Gear Investments and edited by Marc J. Sharpe for TFOA

Over the past fifteen years, the energy industry has experienced significant challenges, which yield compelling opportunities today…

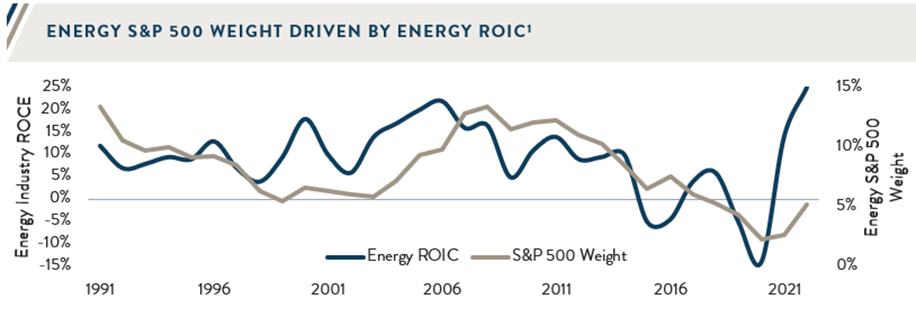

The Global Financial Crisis triggered a flood of capital into the market, ultimately hurting the returns on capital for energy investments due to their long-lived, capital-intensive nature. Over time, the shortcomings of spending on high-decline shale were seen and Returns on Invested Capital (ROIC) fell by nearly 2000 bps (20%) over the 2006-2019 period. As ROIC dwindled, mainstream investors retreated, further deepening the challenges by 2020.

As ROIC fell, generalist investors shunned energy companies, and these capital-intensive businesses could not secure development capital.[1] Over time, the fiscal situation worsened, investor apathy increased, and in 2020, capital disappeared; this forced additional bankruptcies, dividend cuts, and significant layoffs to self-fund ongoing operations.

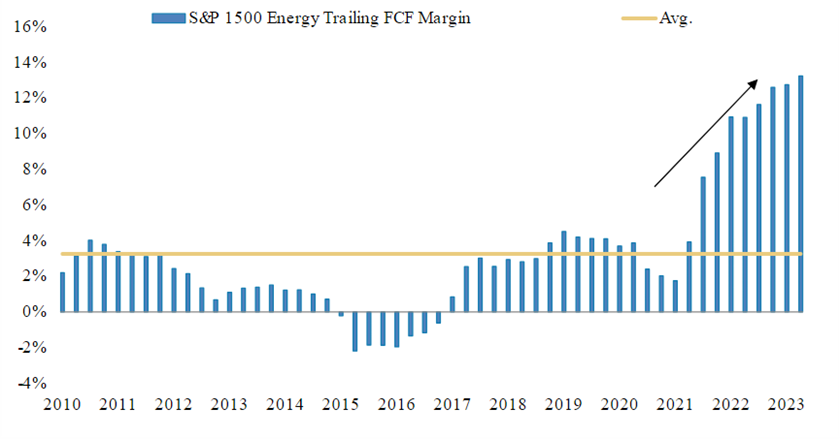

However, the industry shifted its focus, prioritizing returns over asset growth, leading to a “Renaissance of Energy.” Despite these positive changes, many outside the sector remained oblivious. But the numbers speak for themselves. The industry is now making steady progress, and the increasing Free Cash Flow (FCF) to energy is undeniable evidence of this evolution.

Efficiency, Optimization, and Technology

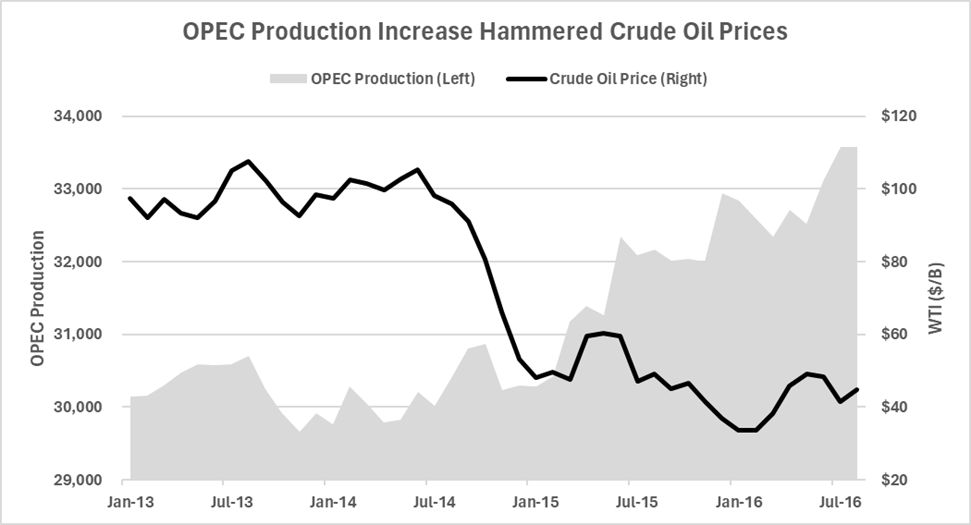

Contrary to popular belief, OPEC's decision to increase production in 2014 was not targeted at U.S. shale but at large investment programs that required high commodity prices ($100/bbl+) to justify their significant capital investment and long gestation periods (5-7+ years to first production). OPEC’s strategy led to financial strains across all energy sub-sectors as investment was slashed in every vertical. However, this gave rise to a new era focused on capital discipline and resource optimization (i.e., inventory management and cost efficiency).

In 2020, there was a further reallocation of capital towards renewable electrification as many investors left traditional energy for more compelling narratives around renewables; clearly, a material change in behavior was underway.

However, what hasn’t changed is the notion that investors should embrace (and prioritize) companies generating tangible free cash flows, especially with rising capital costs and inflationary pressures, to earn a positive return on their investment. Investors should also recognize that traditional hydrocarbon producers contribute significantly to developing emerging technologies due to their financial strength, engineering expertise, and asset mix, allowing for commerciality and scalability assessments.

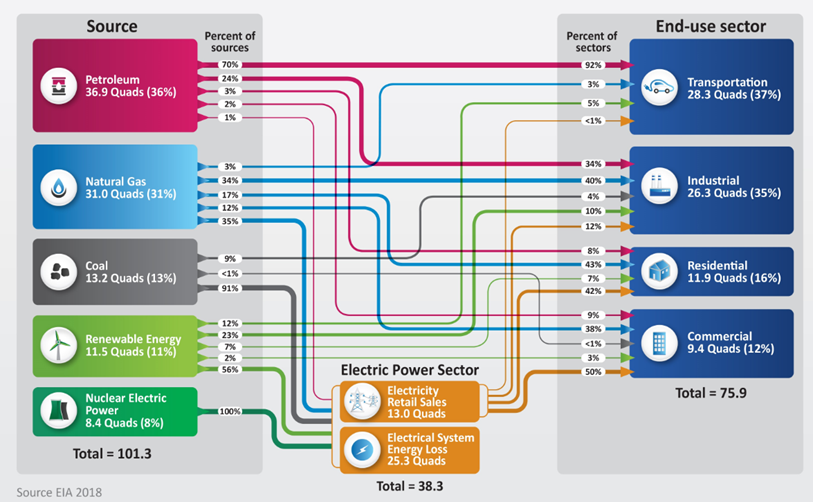

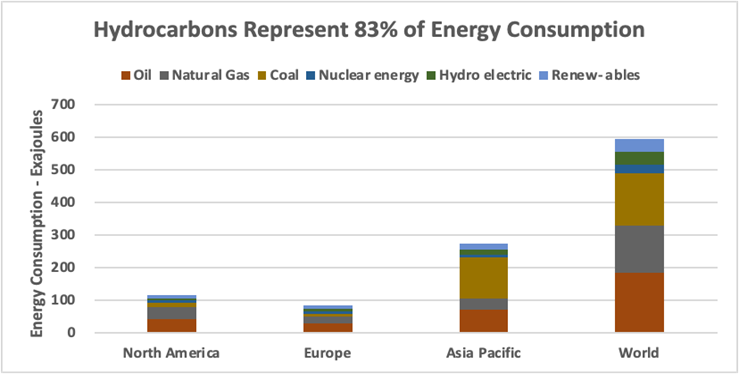

These alternative energy investments are in addition to traditional energy companies enabling global economic growth as they maintain investment in the fuels that power 93% of electricity demand today while working to improve (reduce) their carbon emissions. Hydrocarbon companies have traditionally focused on asset growth, but now they are increasingly prioritizing improved returns; efficiency and technology are potential ways to improve the company’s margins and environmental footprint simultaneously.

For example, heat loss accounts for approximately 25% of the lost energy supply, making resource optimization a top priority for industry (and the global economy). New technologies are promising, but old technologies are still the easiest path to improved energy supply and a lower carbon footprint. The hydrocarbon industry is investing more in resource optimization, which will help to maintain and enhance hydrocarbon supply. That said, demand continues to rise, with OPEC forecasting 105.2 MMBD in Q4 2024 (up 3% from the current 102 MMBD) and 110 MMBD in 2030; and supply growth will be challenged to meet this demand over the next 5-7 years due to insufficient investment. As such, we also need new sources of incremental electricity supply to support future demand needs. Therefore, the energy renaissance is an exciting time for industry, and we all hope for a cleaner, more efficient energy future.

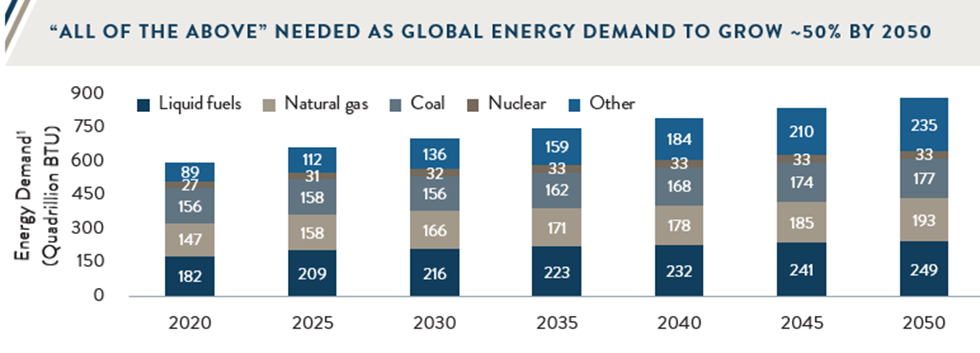

The world will unlikely abandon any source of hydrocarbons for electric power generation for decades; this is an evolution of energy, not a transition from hydrocarbons. It is essential to appreciate this narrative because as energy consumption per person grows, it is not being met with improved efficiency elsewhere. Therefore, while the percentage growth rate of a specific energy source may slow, it is still growing on an absolute basis. Javon’s Paradox supports the narrative: efficiency enables one to use more of what they have, not to use less due to efficiency gains.

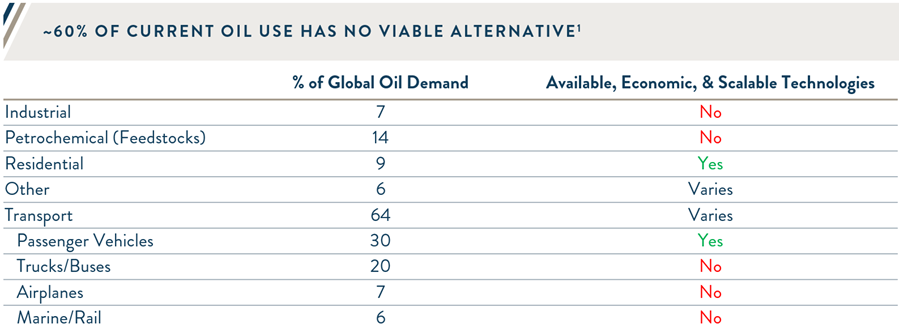

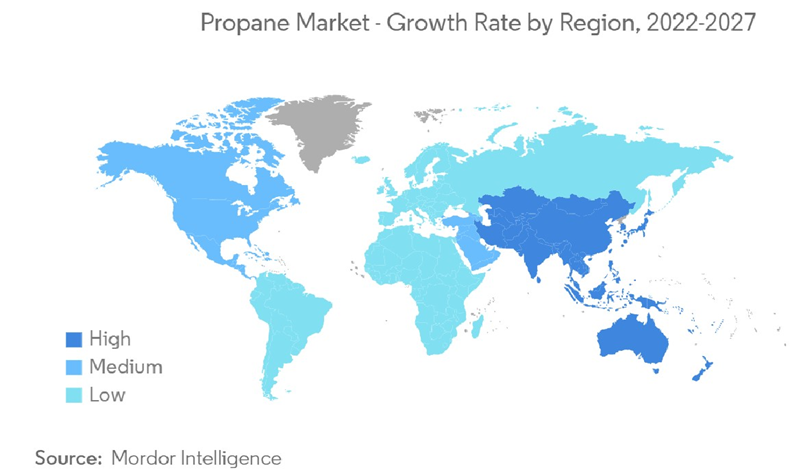

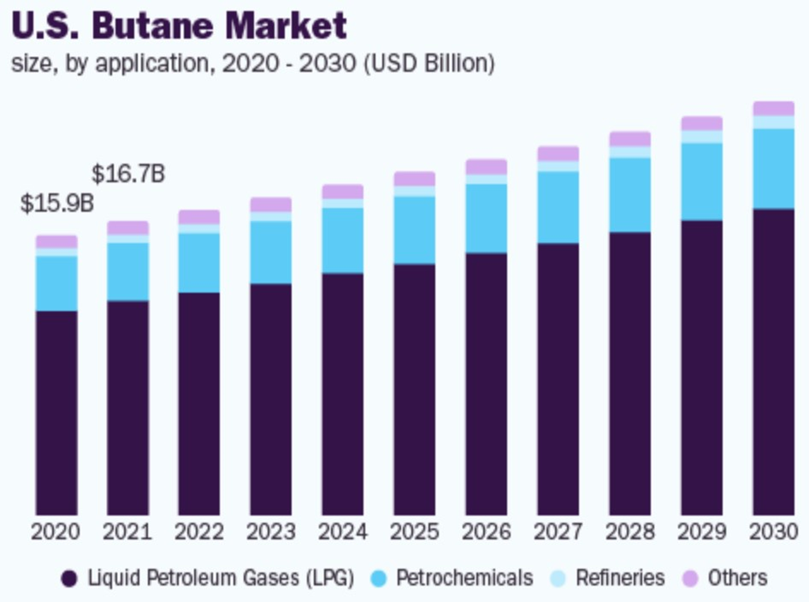

Hydrocarbons are the building blocks of consumer society, and nearly 60% of global end-use products have no alternative to hydrocarbons. Natural gas, propane, ethane, and butane demand is expected to grow approximately 5% annually over the next decade. With ~1.2 billion people entering the middle class by 2030 and nearly 3 billion in energy poverty, demand for all energy sources will continue to grow.

Renewables will not ‘democratize’ energy overnight, as the power sector has struggled with integrating intermittent forms of electricity. Therefore, the global market will continue to rely on natural gas, coal, and nuclear to accommodate imbalances from weather seasonality.

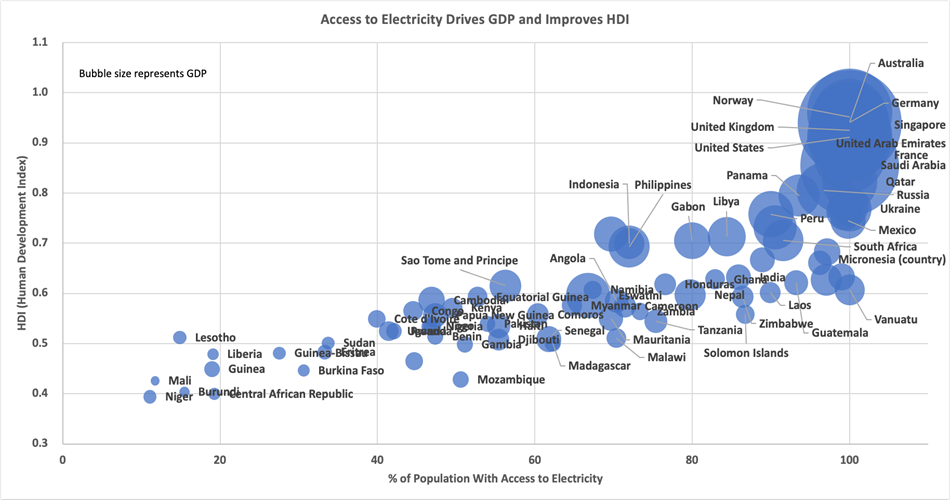

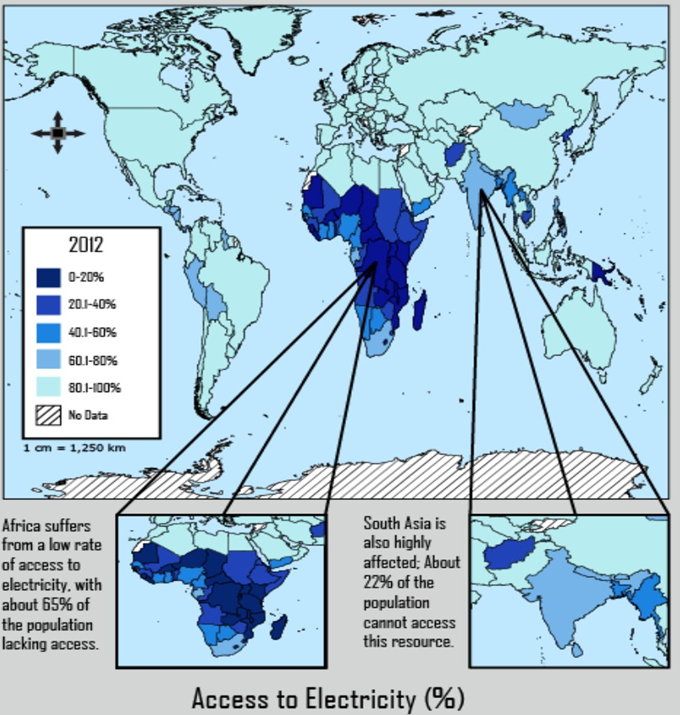

Energy security, reliability, and affordability are fundamental rights for the global population; they drive points 1-3 of the UN Sustainable Development Goals. In the IEA (International Energy Agency) Outlook of December 2022, 775 million people globally lack access to electricity, equivalent to the populations of the US and EU. This number is expected to increase through 2025, primarily in Africa and Oceania, where population growth is highest.[2]

By 2050, Asia and Africa will comprise 80% of the global population, while North America and Europe will only represent 11.7%. Incremental energy demand will come from these regions rather than the US and Europe.

Global energy consumption has nearly tripled since 1971, from 230 EJ to 608 EJ in 2019. Coal demand saw its market share go from 26.1% to 26.8%; in absolute terms, coal generated 60 EJ of power in 1971 and nearly 162 EJ in 2019 – more than triple.

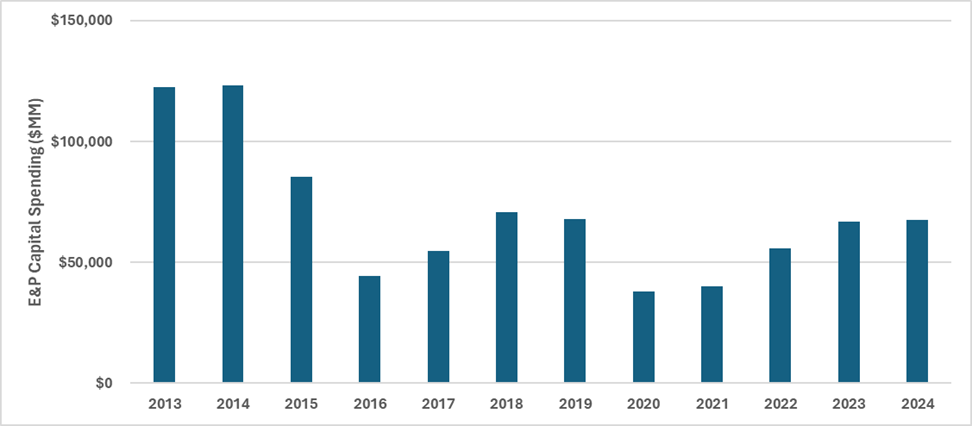

When one contemplates the future of crude oil, natural gas, and natural gas liquids, to paraphrase Mark Twain: “It seems as though the tale of [their] demise is greatly exaggerated.” Unfortunately, energy investment in these hydrocarbons has fallen significantly, with current global upstream capex at less than half the levels of 2012-2014 (while crude oil prices are at the same levels), and with no signs of increases ahead, capital discipline is the new mantra in the oil patch and returns on invested capital are rising.

Fortunately, global markets have become increasingly comfortable with natural gas as a transition fuel. Still, propane, butane, ethane, and crude oil will also play an essential part in improving the energy security, affordability, and reliability of global electricity demand and HDI (human development index) improvement. For example, the IEA forecasts that propane, butane, and ethane will see demand growth of nearly 5% annually through 2030. Without significant new sources of supply, prices will rise, which benefits margins and delivers more free cash flow.

The growth in natural gas liquids demand is supported by the massive growth emerging from the Midland and Delaware Basins in the Permian. The US is well endowed with natural resources, and these molecules are evacuated through the US Gulf Coast midstream and export facilities. The US is now the largest exporter of NGLs globally.

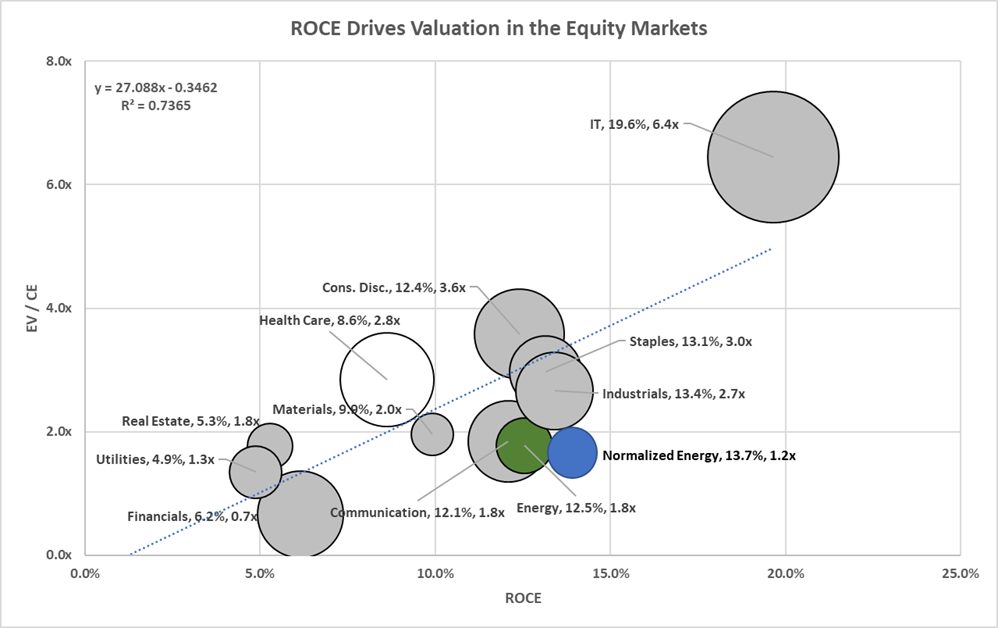

The value of traditional energy, as viewed from the lens of public equities, is likely understated. This is especially true when considering the immense economic costs of ramping up production to satisfy current demand. Over the past decade, the global economy has been flooded with inexpensive energy — a consequence of over $500 billion in lost investor capital. However, management teams are increasingly zeroing in on enhancing their Return on Capital Employed (ROCE). This is a crucial determinant of valuation in the capital markets. Current forward estimates suggest that energy may be undervalued by approximately 35-40% compared to its peers, especially considering the ROCE. And this assessment may be conservative due to three main reasons:

1. Supply growth is decelerating, whereas demand continues to climb.

2. Energy companies have significantly improved their leverage ratios, leading to superior earnings quality and reduced volatility.

3. Increasing capital discipline and industry consolidation will compel companies to maximize their existing resources.

The near-term future suggests a rise in hydrocarbon prices, given that supply is expected to lag demand. Inventories, when adjusted for demand, are at historic lows. Until a short while ago, OPEC was producing at its peak capacity. Many OPEC+ nations are yet to fulfill their designated quotas. Throughout 2022, Russian crude oil and other products flowed continuously into China and India. The US Strategic Petroleum Reserve introduced an additional 750 MBD into the market during the same period. This was concurrent with a withdrawal of nearly two million barrels a day of demand from the market, attributed to China's zero-COVID policy; both factors have since reversed.

The recent cut by OPEC, spearheaded by Saudi Arabia, reflects strategic foresight. They recognize the peril of halting hydrocarbon investments in the US. If prices stagnate between $60-$70 for a prolonged period, it's likely to deter producers from investing. Given the ever-increasing global demand, this would hasten the natural decline of fields and pose a more significant challenge in just a few years. With Saudi Arabia at the helm, OPEC+ isn't merely playing the game; they're strategizing several steps in advance.

Of critical note is India's looming surge in demand. Although lagging behind China by approximately 15 years, India has a population of 440 million below 18. This promises a sharp spike in demand over the next decade. Yet, there are no ready resources to counterbalance this anticipated near 10% hike in global demand.

Valuation & Market Leadership: Both Are Improving

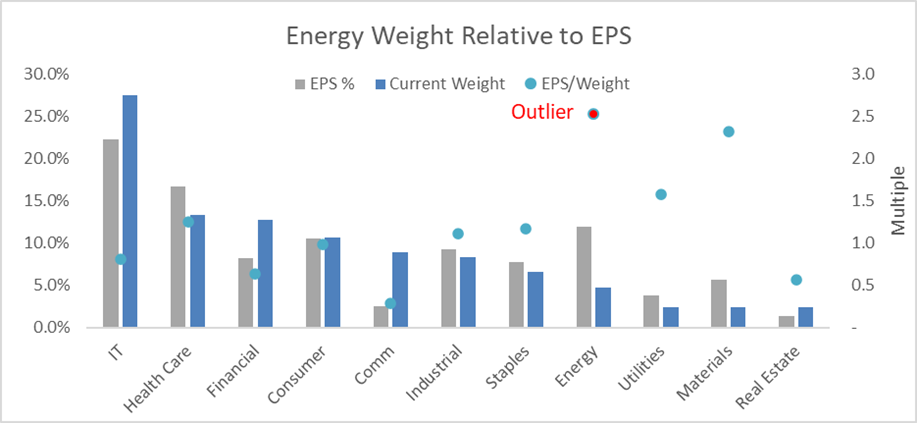

The S&P Energy composite will represent nearly 10-13% of S&P EPS in 2023-2025 but is a mere 4.8% of the S&P 500. Ten (technology) companies in the S&P 500 currently represent 34% of the total market capitalization and trade at an average 50x P/E multiple. Energy multiples have contracted over the past decade, while technology multiples have expanded significantly. A notable change of leadership is emerging.

Public energy equities are expected to deliver industry-leading returns on capital, which should drive multiple expansion and improve valuation. As the market adapts to the new paradigm, the outlook for all hydrocarbon prices is higher. Importantly, for the energy investor, this demand has been increasingly met by US Shale – the Permian Basin – and the US Gulf Coast. If management discipline continues, it should drive improved valuation in the equity markets, and the Renaissance of Energy will be at hand.

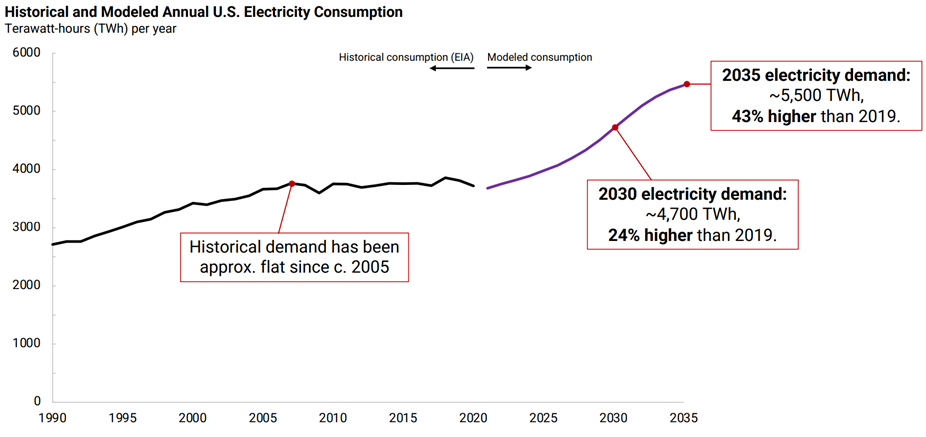

Electrification is a cornerstone in our transition to a low-carbon economy, with every energy source holding a pivotal role in this transformation. Renewable electricity is on an impressive growth trajectory. Yet renewables account for a mere 7% of global energy consumption. The projected surge in electricity demand will dwarf the forecasted growth of renewables. Princeton University predicts a 43% increase in electricity demand in the US by 2035 – electricity demand has been flat for 20 years, but AI, Cloud Computing, and EVs are dramatically changing that.

A modest 2% uptick in global energy demand would necessitate renewable power generation equal to roughly 30% of the existing infrastructure. Therefore, the Energy Renaissance needs to be holistic and encompassing – an "All-of-the-Above" stance. However, staying financially grounded, operationally pragmatic, and commercially realistic.

An “All-of-the-Above” Approach Should Provide Energy Stability, Reliability, and Affordability.

In conclusion, the exponential growth in global energy demand will compel the world economy to incorporate more nuclear and renewable sources while acknowledging the indispensable role of hydrocarbons. As a stable and consistent energy foundation, hydrocarbons fuel both emerging economies and the progress of developing nations. Their significance in our future energy landscape remains undeniable.

Strategic investments in energy companies and new technologies, primed for scaling and commercialization, are essential to satiate this burgeoning demand. Traditional energy companies have often been in the crosshairs of environmental concerns and greenhouse gas emissions. Yet, the undervaluation they face in the market currently offers an attractive prospect for investing in these vital hydrocarbon companies as they work to improve their environmental footprint.

-----------------------------------

Third Gear Investments is an energy investment firm focused on delivering attractive returns via public equities. Our Partners and Advisors have decades of experience understanding the industry's cyclicality. They are poised to invest in a sector that has a massive bifurcation in the understanding of energy today versus that of the past. Our pragmatic and “All of the Above” approach is agnostic and holistic in purview but grounded in returns on invested capital. Third Gear believes the drive for clean energy creates significant opportunities; disruptive technologies and timing of capital mismatch will challenge the market to meet growing demand. Underinvestment in traditional energy resources and the scalability of additional sources of electrification are creating attractive investment narratives.

Sean M. Maher is a Partner and Co-Founder of Third Gear Investments (TGI). TGI was founded in 2023 to redefine energy investment. Before founding Third Gear, Mr. Maher managed public equity portfolios for an energy boutique for fifteen years and served as a publicly traded energy company director. He began his career in energy finance at Morgan Stanley’s energy investment banking program in 1999 before covering Integrated Oils, Independent Refining, Midstream, and Integrated Natural Gas in the firm’s Equity Research division. Mr. Maher serves as Chair of the Investment Committee for the Houston Museum of Natural Science and as a Trustee for Covenant House Texas. Contact: smaher@thirdgearinvestments.com

The Family Office Association (“TFOA”) is a global peer network that serves as the world’s leading single family office community. Our group is for education, networking, selective co-investment, and a resource for single family offices to share ideas, deal flow and best practices. Members are not actively marketing products or services to other members and no contact information or email lists will ever be shared. Since our founding in 2007, TFOA has led the global single family office community by delivering world-class educational content, unique networking opportunities, and exceptional thought leadership to our highly curated network of the world’s largest and wealthiest families.

Marc J. Sharpe is the founder and Chairman of TFOA, an organization formed in 2007 to provide a forum for education and networking and to serve as a resource for single family office principals and professionals to share ideas and best practices, pool buying power, leverage talent and conduct due diligence. Mr. Sharpe also teaches an MBA class on “The Entrepreneurial Family Office” as an Adjunct Professor at SMU Cox School of Business: Contact: marc@tfoatx.com

IMPORTANT NOTES

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. Responses to any inquiry that may involve the rendering of personalized investment advice or effecting or attempting to effect transactions in securities will not be made absent compliance with applicable laws or regulations (including broker dealer, investment adviser or applicable agent or representative registration requirements), or applicable exemptions or exclusions therefrom.

This document, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated, or disclosed, in whole or in part, to any other person in any way without the prior written consent of Third Gear Investments, LP (“Third Gear”). By accepting this document, you agree that you will comply with these restrictions and acknowledge that your compliance is a material inducement to Third Gear providing this document to you.

This document contains information and views as of the date indicated and such information and views are subject to change without notice. Third Gear has no duty or obligation to update the information contained herein. Further, Third Gear makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Third Gear believes that such information is accurate and that the sources from which it has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials. Statements made herein that are not attributed to a third-party source reflect the views and opinions of Third Gear.

This document contains forward-looking statements, including observations about markets and industry and regulatory trends as of the original date of this document. Forward-looking statements may be identified by, among other things, the use of words such as “expects,” “anticipates,” “believes,” or “estimates,” or the negatives of these terms, and similar expressions. Forward-looking statements reflect Third Gear’s views as of such date with respect to possible future events. Actual results could differ materially from those in the forward-looking statements as a result of factors beyond Third Gear’s control. Readers are cautioned not to place undue reliance on such statements. Third Gear bears no responsibility or obligation to update any of the forward-looking statements in this document.

Charts, tables and graphs contained in this document are not intended to be used to assist the reader in determining which securities to buy or sell or when to buy or sell securities.

Disclosures

TFOA is a peer network of Single Family Offices. Our community is intended to provide members with educational information and a forum in which to exchange information of mutual interest. TFOA does not participate in the offer, sale or distribution of any securities nor does it provide investment advice. Further, TFOA does not provide tax, legal or financial advice. Materials distributed by TFOA are provided for informational purposes only and shall not be construed to be a recommendation to buy or sell securities or a recommendation to retain the services of any investment adviser or other professional adviser. The identification or listing of products, services, links, or other information does not constitute or imply any warranty, endorsement, guaranty, sponsorship, affiliation, or recommendation by TFOA. Any investment decisions you may make based on any information provided by TFOA is your sole responsibility. The TFOA logo and all related product and service names, designs, and slogans are the trademarks or service marks of The Family Office Association. All other product and service marks on materials provided by TFOA are the trademarks of their respective owners. All of the intellectual property rights of TFOA or its contributors remain the property of TFOA or such contributor, as the case may be, such rights may be protected by United States and international laws and none of such rights are transferred to you as a result of such material appearing on the TFOA web site. The information presented by TFOA has been obtained by TFOA from sources it believes are reliable. However, TFOA does not guarantee the accuracy or completeness of any such information. All such information has been prepared and provided solely for general informational purposes and is not intended as user specific advice.

[1] Importantly, as shown later in the white paper, E&P companies had already begun to adopt discipline by reducing capital spending.

[2]Africa’s population is growing at approximately 2.5% per year versus Europe's 0.06% and North America's 0.62% (including Mexico's).