Family Office Direct Investing Survey

Marc J. Sharpe & Seth Morton

In 2018, investors Mohnish Pabrai and Guy Spier spent $650,100 to have lunch with Warren Buffet. These charity lunch auctions are a regular event for the Glide Foundation and illustrate how much some are willing to pay to learn from The Oracle of Omaha. While we can’t promise this whitepaper will provide millions of dollars in value to our readers, we do hope that it offers some unique insight into the best direct-investment practices that The Family Office Association’s (TFOA) community of single family offices have learned over the years. Many of our family office members echo the advice Buffet offered Pabrai during their lunch, namely invest in what you know and focus on a long time horizon instead of a “quick flip.”

Since TFOA’s inception in 2007, we’ve found there are two basic motivations for single family offices to join our private family office peer network. Some are looking for a safe place for support and advice for matters ranging across operations, structure, design, governance, and long-term planning. Others are looking for like-minded families to co-invest with on direct investments, where they can share their expertise and benefit from proprietary sources of deal flow.

Over the years we’ve learned much from our members about what drives them, the advantages they bring to direct investing, and their approaches to direct investing operations. While TFOA’s membership represents a small fraction of the total family office universe, their insights align well with the growing body of knowledge around what makes family office direct investing successful (or not). To share some of these hard-earned insights, we conducted a survey of our members over a two week period in June 2022, with a series of questions about their direct investing habits.

Family Office Direct Investing

Our data is fascinating. Thirty nine single family office principals and executives answered eleven questions regarding their direct investing practices and shared some of the key insights they’ve learned over the course of their investing career.

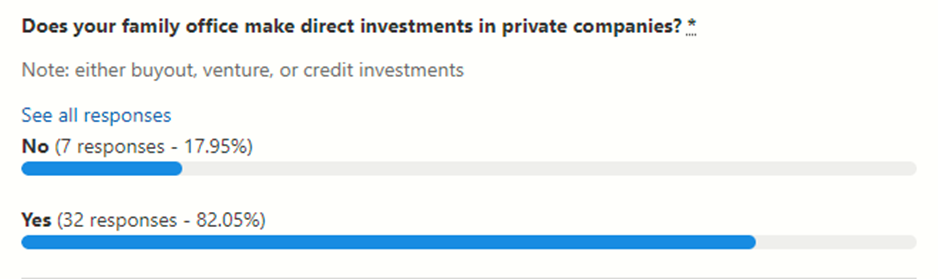

The first thing we learned is that over eighty percent of respondents make direct investments in private companies. With patient capital, a team of administrative and investment professionals, and access to off-market opportunities, many family offices clearly feel like they have all the necessary ingredients to source, screen, and execute a direct private investment program successfully. But the desire to execute private, direct deals does not necessarily equal the ability to do so. As we’ve discussed in previous whitepapers, a common behavioral driver is the “Fear of Missing Out” or FOMO. Thus, even when a family office has access to the basic ingredients for successfully pursuing direct investments, they may not have the team, capacity, or pipeline of opportunities to sustain a direct investing program beyond a handful of opportunistic deals. To explore this further, we asked what the primary drivers were that initially led respondents to pursue a direct investing strategy within their family office.

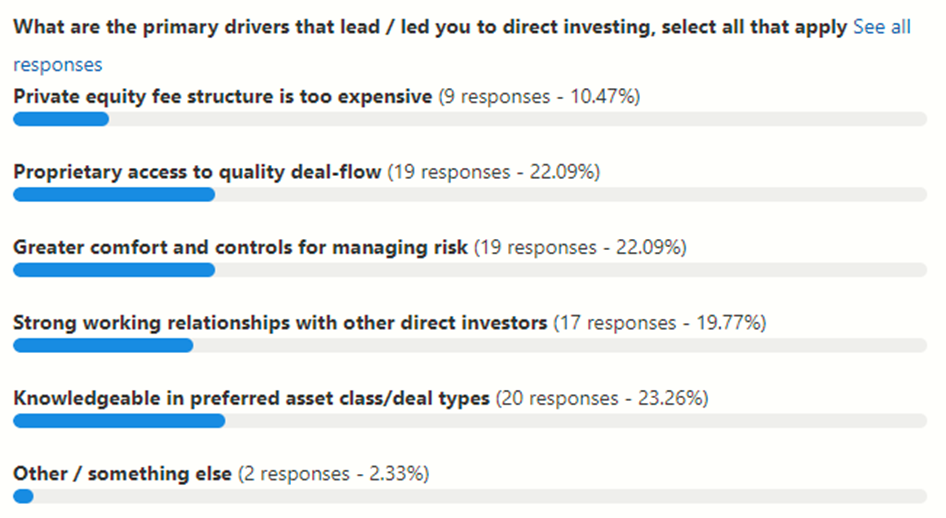

The results were broadly split across a range of factors, including access to proprietary deal flow, the desire for greater control, close relationships with other direct investors, and specific domain expertise in certain industries and asset classes. Interestingly, private equity fund fees were not mentioned as a major driver, suggesting that fee structure is not as important as more qualitative factors like access to quality deals, strong partnerships, and industry expertise. The evenness across the board shows that family office investors aren’t focused on one particular driver, but rather have a holistic view that values a range of factors in assessing direct investment opportunities.

Of course, the question of fees is not an inconsequential one. The costs of administering a direct investing program can quickly eat into performance. One family offered the following advice: “If you can’t source, diligence, and execute a specific strategy in-house for less than 2/20, then outsource it to a manager who has the resources and expertise in that area.” This respondent uses the private equity fee structure as a ‘cost-basis’ to measure their in-house activity against. A framework like this might not work for all families, but it is a simple framework to think about when considering whether a direct investing program makes sense to pursue internally or to outsource to a third-party private equity fund.

Direct Investing Challenges

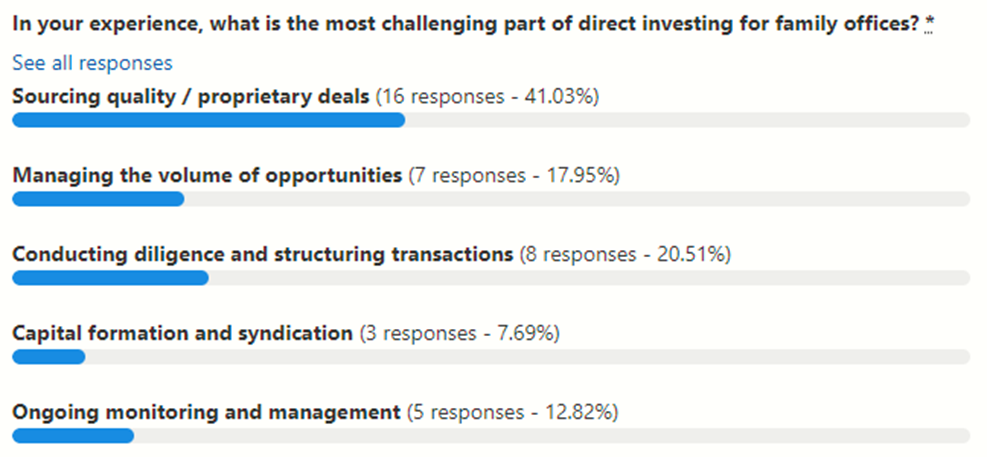

When it comes to managing risk, many of our family office respondents identified 'sourcing quality investments’ as the most challenging component of implementing a successful program.

When you have access to high quality opportunities, all the subsequent elements of risk management become significantly easier. If there is one piece of advice to take away from our survey, it may be this comment from one of our respondents: “Focus your energy on identifying and building relationships with excellent sources for deal flow.” This is easier said than done, as most sponsors believe that their deal flow is excellent. One cannot understate the importance of finding good partners that are trustworthy and can deliver on their claims.

When asked to expand on how they would like to improve their investment practices in the future, fifteen respondents noted aspects related to diligence, information management, transparency, and other aspects of investor relations. Our conclusion is that while sourcing may be the greatest challenge, developing an efficient and coherent methodology to diligence and manage investments represents the largest area for targeted internal improvement. As families consider how to best assess and improve their operations, we think a candid-self inventory is a good place to start.

Developing A Candid Self-Inventory

Family offices interested in building out their direct investment capabilities, or family offices looking to improve their existing operations, need to take a candid self-inventory of their capabilities (as well as their goals). One of the unspoken advantages of having a family office is that you have a group of professionals with enough critical distance and capability to provide insight into the gap between how a family office perceives their abilities vs. where their abilities actually are.

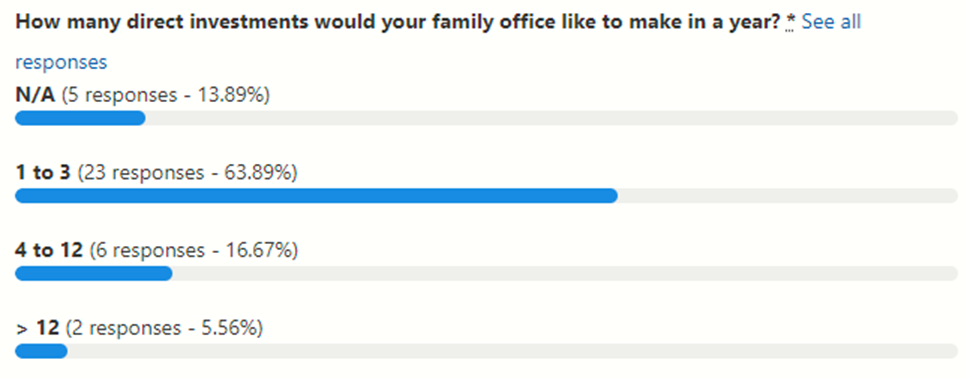

While many families are interested in seeing opportunities, the majority of our respondents execute between one and three opportunities per year. If you’re a sponsor in conversation with a family office, it’s good to have a sense of the volume of deals they execute and to measure your opportunity against the kinds of deals \ the family typically makes. While a lot of ink can be spilt on designing and managing a risk-mitigated direct investing platform, the actual volume that the platform manages may be relatively small, especially in comparison with other parts of the allocation, and therefore may not be worth the investment of time, capital, or administrative resources.

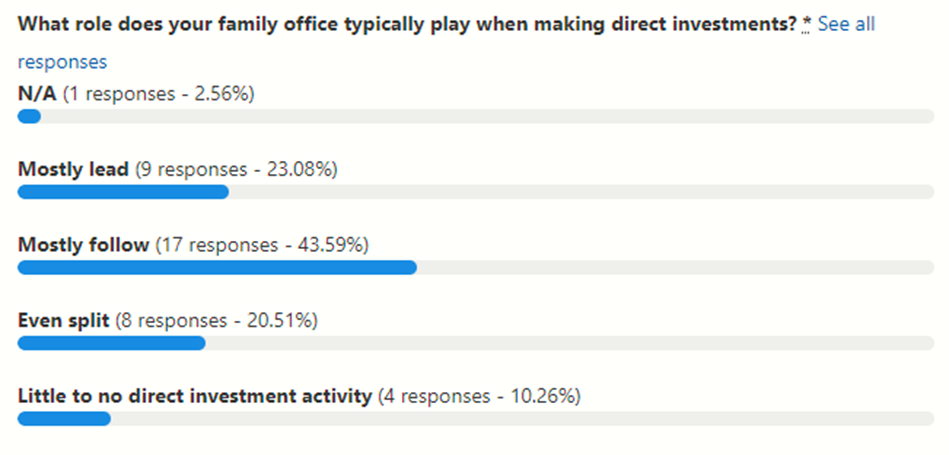

When it comes to investment style, our family office respondents lead the investments less than thirty percent of the time. It’s important to point out that team bandwidth is often a limiting factor for even the most well-staffed family offices; and the costs of increasing team capability may not improve the return on investment a family office receives versing investing with an established private equity firm.

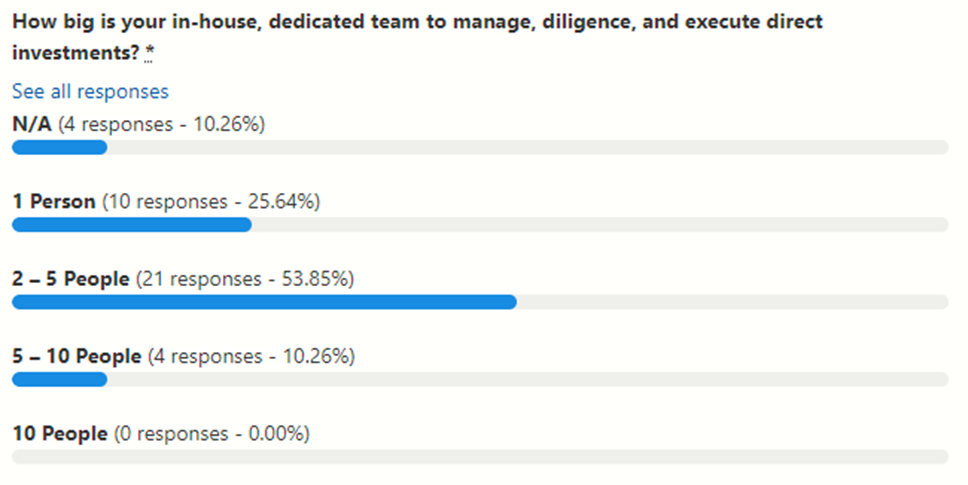

Most of TFOA’s members have teams comprised of 1 – 5 people, and given the volume of deals per year, many of these individuals are likely tasked with other aspects of investment and asset management besides direct deals.

When it comes to self-assessment, there are three broad categories that should be considered: sourcing, vetting, and executing. In each of these categories the thrust of the inquiry should examine the limits of the ability when measured against a set of viable alternatives. With regard to sourcing, how truly unique and off-market are the deals that you have access to? If you wanted to improve your access, what steps would the family office have to take and how long would it take to generate results? Is your access to off-market opportunities truly better than some of the large or boutique firms that specialize in these strategies?

Regarding vetting, given the size and background of your team, how many deals per quarter can they reasonably screen, diligence, negotiate, and deploy capital to? What are the capabilities of your management team (in many cases this is the same team that’s charged with overseeing the diligence process) and how disciplined are you as a buy-side investor? Do you have a clear exit strategy in place for your investments and do you have the resources and patience necessary to achieve those exit strategies?

The result of this kind of self-inventory is not a simple binary between either doing direct deals or not doing direct deals, but rather it creates a better sense for a family office’s capabilities. If the gap between ability and desire is large, there are usually ways a family office can draw these two poles together. Networks like TFOA exist to provide peer-support and direct knowledge transfer from families that have successfully navigated these waters.

One of the structural challenges for a family office direct investment program is the balancing act with working with others while also maintaining their exemption status under the family office rule. One of the tenets of the rule is that no family can hold themselves out to the public as an investment adviser. Private investment clubs and networks can help manage the desire for families to partner with others on specific projects, without being in violation of the rule.

It is with this in mind that TFOA has developed a co-investment option that allows members to bring investments to the group to invest collaboratively. This not only saves on administrative costs but allows members to co-invest with each other without having to take on the regulatory burden that would come from raising funds by registering with any regulatory body. And importantly, this allows family’s to execute opportunities and form capital with their peers without having to reinvent the administrative wheel every time they want to do so.

The Pros and Cons of Direct Investing

As touched upon in the preceding paragraphs, there is an array of advantages that family offices can leverage to justify having a direct investing program. For example, the family office may have a particularly strong understanding of a specific asset class, business, or industry because of the family’s legacy operating company; the family office typically has patient capital; and, the cost of the transaction can be lowered by leveraging existing resources that sit within the family office (in particular, without a third party manager, investments are not subject to a fee structure like the traditional 2% management fee and 20% carried interest on profits).

But there can also be disadvantages to bringing direct investing in-house for some family offices. The knowledge advantage that a family may possess within a certain industry can lead to concentration risk. Greater control of the direct investing program may also lead to greater exposure to operational risk and expanding overhead or administrative costs (that may ultimately become greater than a 2 and 20 fee structure). Finally, there is the risk of SEC oversight if the family office rule is ever breached for any number of reasons that we don’t have the time to go into in this short whitepaper. As a result of these risks, the direct investment platform can end up taking a disproportionate time and costing significantly more resources than the returns ultimately justify.

Successful direct investing is not a question of size or scale, but simply about correctly aligning the family offices’ operations in terms of incentives and ability. In the words of one member: “Invest in what you understand. Look for simplicity in structure.” While it may be easy to get caught up in the moment, feeling the pull of FOMO, or perhaps being lured into a complex new security that might boost returns or improve diversification; successful family office direct investors have learned to proceed with caution and temper their expectations. One of our Single Family Office members offered this advice for any family office interested in direct investing: “If it doesn’t pass the initial smell test, move on immediately.” Simple common sense wisdom is often the most profound!

If you'd like to stay in touch on a more frequent basis, please follow us on LinkedIn and Twitter. In the meantime, please check out our free library of family office whitepapers, podcasts and videos at Media. Thank you!

Marc J. Sharpe is the founder and Chairman of TFOA, an organization formed in 2007 to provide a forum for education and networking and to serve as a resource for single family office principals and professionals to share ideas and best practices, pool buying power, leverage talent and conduct due diligence. Mr. Sharpe is active in the community and has served on the Board of the Holocaust Museum Houston, the HBS Houston Angels, and on the Investment Committee for two Texas based foundations.

Seth Morton, Ph.D. has served family offices in areas of investment diligence, execution, and management; governance; research; communications; and multi-generational, sustainable legacy planning. He seeks to improve team performance by cultivating learning-focused and communications- driven processes that deliver exceptional results. He and his family are currently based in Texas.

TFOA is a peer network of Single Family Offices. Our community is intended to provide members with educational information and a forum in which to exchange information of mutual interest. TFOA does not participate in the offer, sale or distribution of any securities nor does it provide investment advice. Further, TFOA does not provide tax, legal or financial advice. Materials distributed by TFOA are provided for informational purposes only and shall not be construed to be a recommendation to buy or sell securities or a recommendation to retain the services of any investment adviser or other professional adviser. The identification or listing of products, services, links, or other information does not constitute or imply any warranty, endorsement, guaranty, sponsorship, affiliation, or recommendation by TFOA. Any investment decisions you may make based on any information provided by TFOA is your sole responsibility. The TFOA logo and all related product and service names, designs, and slogans are the trademarks or service marks of The Family Office Association. All other product and service marks on materials provided by TFOA are the trademarks of their respective owners. All of the intellectual property rights of TFOA or its contributors remain the property of TFOA or such contributor, as the case may be, such rights may be protected by United States and international laws and none of such rights are transferred to you as a result of such material appearing on the TFOA web site. The information presented by TFOA has been obtained by TFOA from sources it believes are reliable. However, TFOA does not guarantee the accuracy or completeness of any such information. All such information has been prepared and provided solely for general informational purposes and is not intended as user specific advice.