Why Venture Backed Immigrant Founders Succeed

Marc J. Sharpe, Andrew Probasco, Sunny Zhang, & Sandip Bordoloi

Executive Summary

Immigrant entrepreneurs outperform in founding U.S. unicorns and Fortune 500 companies, creating patents and jobs, and powering innovation in the U.S. economy. This white paper reviews findings from research to demonstrate the success of immigrant innovators and entrepreneurs and explore the reason(s) for their success, including the networking advantage they bring through the companies they lead that specialize in global markets at conception affording these firms a greater chance to succeed and scale.

Key Stats

· 55% of unicorns (billion-dollar startups) have at least one immigrant cofounder. National foundation for American Policy (2018).

· 43% of Fortune 500 firms in 2017 and 57% of the top 35 firms were founded by immigrants and their children. Center for American Entrepreneurship (2022).

· 35% of U.S innovation and entrepreneurship is created by immigrants accounting for 13.7% of the U.S. population. (Kerr & Kerr, 2020; Budiman, A. 2020).

· 20% of the world’s tech founders are immigrants, while they only make up about 4% of the world’s population. The Global Startup Ecosystem Report by Startup Genome (2022).

Unicorns and Outliers

What do SpaceX, Zoom, Wish, Robinhood, Stripe, Uber, DoorDash, InstaCart, and Pfizer have in common? Each one is a U.S. unicorn (i.e., a privately held company with a valuation of over 1 billion dollars) and each one was founded by immigrants. The overwhelming majority of unicorns are tech startups supported by venture capital funding which has generated tremendous returns for their investors.

The overwhelming majority of unicorns are tech startups supported by venture capital funding. Collectively, the VC industry in tech has generated tremendous returns for its investors. Broad research exists on the various factors that drive the success of unicorn companies. Among these are the number of founders, the time required to achieve unicorn status, the variety of industries, and the characteristics of founders.

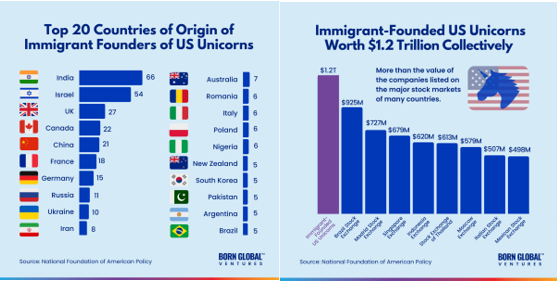

Unexpectedly, 55% of U.S unicorns studied had at least one immigrant founder (Anderson, 2022). This finding echoes the disproportional success rate among Fortune 500 companies, of which 45% were founded by first- and second-generation immigrants.

Ilya Strebulaev, a tenured professor with the Stanford Graduate School of Business and head of the Venture Capital Initiative, a research group chartered to keep tabs on entrepreneurship, private equity investments, and the impact of venture capital on business, using recent data, has discovered a series of revealing correlations between venture funding, immigrants, and success.

Based on the research of 1,123 U.S based unicorns with some VC backing, start-ups with 3 or 4 immigrant co-founders were a whopping 74% more likely to reach unicorn status. Interestingly, Dr. Strebulaev’s highly representative sample indicates a series of significant correlations between immigrants, their education, their success in corporate leadership, and their success as founders.

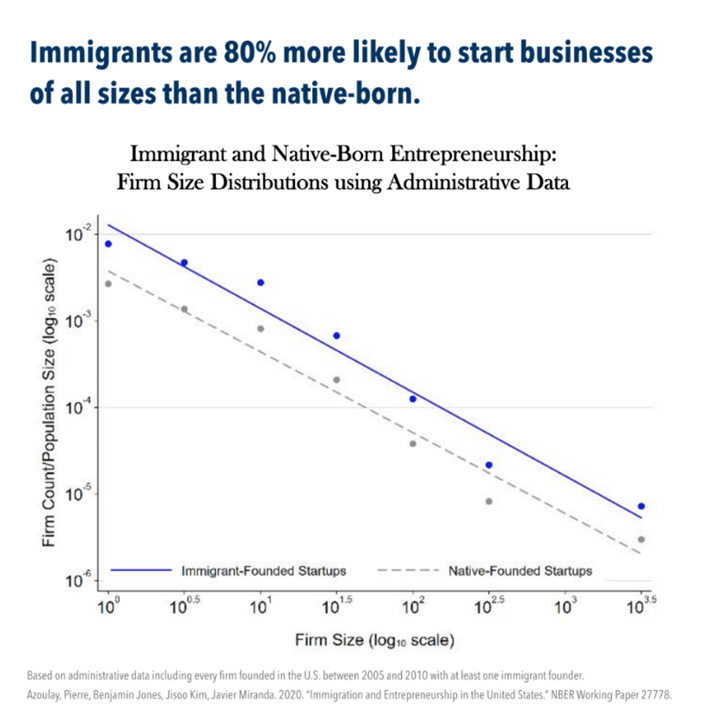

Immigrants Outperform in Entrepreneurship and Inovation

Immigrants’ success in entrepreneurship extends beyond unicorn companies. Between the years 2008 and 2012, immigrants founded 25% of all new businesses (Krol 2021; Kerr and Kerr 2020). When compared to their native-born counterparts, immigrants are 80% more likely to register a business (Dizikes, 2022). Based on 2017 data from Fortune 500 companies, as well as the U.S. Census Bureau’s Longitudinal Business Database, which included information on every new business founded between 2005 and 2010 that lasted at least five years, for a total of 1.02 million firms, immigrants are more likely to found firms (of all sizes) than native-born entrepreneurs.

Immigrants' rate of innovation is also much high than their native-born counterparts. Immigrants account for nearly 1 in 4 U.S. patents, despite constituting only about 14% of the population overall (Azoulay, 2020). From 1975 to 2015, immigrants as a group attained 40% more patents on average compared to all other groups in proportion to their steadily growing percentage of the U.S. population.

Data collected from the U.S. Patent and Trademark Office by Stanford researchers note that the higher number of patents secured by immigrants are in greater use in industry and research. Researchers found that immigrant-originated patents were 40% more likely to be publicly recognized or currently in use. The total speculated economic value of these innovations occurring chiefly through the utilization of patents by public companies is estimated to constitute 25% of economic value, or 50% higher than the overall average (Tam, 2020). Research from the CATO Institute indicates that immigrants are largely the originators of innovation and economic dynamism, rather than the supporters. Data collected from 1975 to 2010 notes that immigrants flowing into the U.S can be tied to a 27% increase in patent acquisition and an increase in regional wages (Burchardi et al., 2020).

Tech Leadership

Data on immigrant founders shows that they have taken on a disproportionately large role in management, product development, and have led several sectors in overall patent attainment. Exclusive use rights have provided their firms with access to new methods integral to emerging product designs. Anderson notes that as of 2016, over 70% of companies involved the contribution of one or more immigrants in a key role in management or product development. As of 2022, nearly 80% of U.S. unicorns have an immigrant founder or an immigrant in a key leadership position.

Notable examples include SpaceX, Uber, and over 30 others. Self-selection bias may be at play given the proportionally higher numbers of immigrant STEM holders. The discrepancy between lower absolute education in the immigrant population and increased numbers of those with STEM expertise is likely the result of a U-shaped skills curve within the immigrant population (Krol, 2021; Ganguli et al., 2020).

Jobs and Value Creation

Contrary to the usual narrative, immigrants create more jobs than native-born entrepreneurs, accordingly to Ben Jones, a professor of strategy at Kellogg. Immigrant-founded companies not only have more patents than native-born-founder-led firms, but they also pay higher wages than native-founded firms. Immigrants are found to be economically compliments in the multiple sectors in which they participate; these groups have been recognized as generators of roughly 25% of American jobs. NFAP finds that privately held U.S. billion-dollar startup companies with immigrant founders have created an average of 859 jobs per company. Thus, immigrants improve the economic outcomes for native-born workers. Immigrant-founded US unicorns are collectively worth $1.2 trillion and would be the 16th largest GDP as a country, more than the value of the companies listed on the major stock markets of most countries.

Self-Selection and Resilience

Many reasons can contribute to immigrant success as startup founders and corporate leaders. Peter Vandor (2021) notes in his Harvard Business Review article that the combination of a high appetite for risk, high achievement motivation, and follow-through are qualities supported by survey data as consistent with a business leader identified as an immigrant.

The ways in which the immigration process leads to a kind of self-selection bias may also be a key contributing factor. Cost, complications, and stringent requirements notwithstanding, the selection involved in F1 and H-1B visa attainment present an often-insurmountable challenge for many prospective immigrants. Given these limits, immigrants who successfully acquire visas and citizenship status exhibit a characteristically uncommon tolerance for risk and adaptability to unfamiliar circumstances.

Research performed by the Vienna University of Economics and Business found that nearly half of students who indicated an interest in starting a business and who also chose to move abroad and return later created a business (Gaskell, 2021). Additional obstructions like labor market discrimination compound these effects.

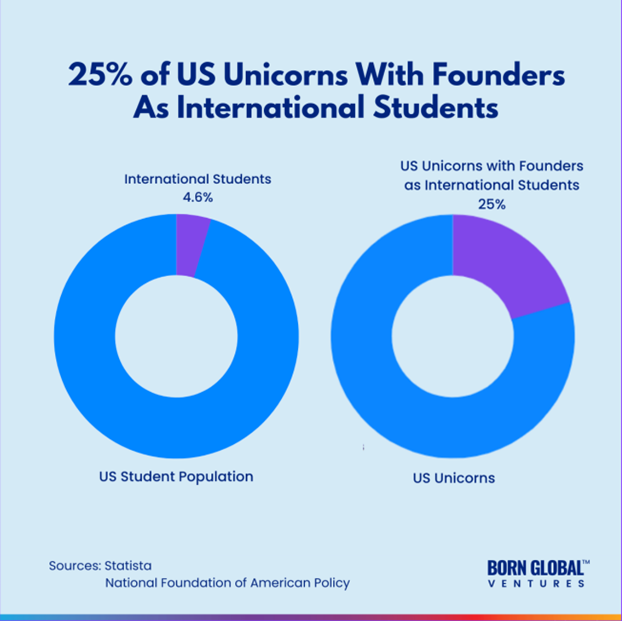

Nearly 25% of U.S. billion-dollar startup firms have a founder who was once an international student (Anderson, 2022). Standards for admission as an international student are considerably higher than average. Furthermore, international students typically seek out universities with high ranking and better outcomes. This historical data review records in years before 2020 indicating that successes were not influenced by recent or intentional changes.

Education

Successful firms in emerging industries like tech need technically astute talent. Although international students only account for 4% of the U.S. university population, they obtained 50% of the graduate degrees in STEM. Immigrants are 40% more likely to hold a doctorate, according to Tam (2020). And immigrants are the majority recipients of higher-level STEM degrees. NFAP found that in 2011, 65% of Ph.D. recipients and 60% of master’s degree students in electric engineering were foreign-born. Similar results appear in fields like computer science, mathematics, and statistics (Anderson, 2013).

The most current data confirm the value of education to financial outcomes led by immigrants vetted through the emigration process. Illya Stebulaeve (2022) found that 21% of these founders were educated, at least in part, in one U.S university. Universities such as the University of Waterloo and Tel Aviv University have developed immigrants who originated at least 26 unicorns. NFAP also found that 25% of billion-dollar startup companies in the U.S. have a founder who attended a U.S. university as an international student.

Among all the immigrant founders of U.S. unicorns, 174 international students became founders or cofounders. International students typically can only remain in the United States long-term after gaining H-1B status and (or) an employment-based green card. Those who have been granted a continuous stay lead these firms.

To be Born Global

Vendor (2021) from the Harvard Business Review quotes “immigrant founders have a competitive advantage when it comes to building impactful, global reaching ventures.” Such firms have a global market strategy at inception. These firms' leadership is more often than not made up of immigrants with diverse backgrounds and competencies relevant to the tech industry.

Simply put, these global reaching ventures are birthed with international orientation by talent originating globally. Their founding teams come from within rather than expand into international markets. Strategic choices made typically mirror the capacities and interests of firm managers who leverage global connections for market access and innovation. These companies leverage local and global ecosystems for innovation and talent acquisition generating a truly unique, difficult to replicate business model. Research indicates that such firm’s success leans heavily on the networking abilities of its founder(s), the globally scalable product, and of course adequate funding (Gabrielsson et al., 2008).

This networking edge has been demonstrated to improve their firms’ chances of success during the take-off early stages of development while positioning them for potentially exponential growth at middle stage and late-stage development. This networking effect lends a competitive advantage due to knowledge generated about the global environment, access to market information, and access to the best products and developers.

Conclusion

The pace at which VC-backed firms achieve billion-dollar valuations is accelerating. In the past 10 years, the number of U.S unicorns has doubled. In the past 5 years, the number of U.S. unicorns went up 500%. For tech startups, global scale companies led by immigrant founders continue to demonstrate real competitive advantages in achieving higher success rates and bringing great returns for investors. This is especially true during times of uncertainty and disruption, given their resilience.

References

· Anderson, S. (2022). Most billion-dollar startups in the U.S. founded by immigrants. Forbes https://www.forbes.com/sites/stuartanderson/2022/07/26/most-us-billion-dollar-startups-have-an-immigrant-founder/?sh=2f84be506f3a

· Anderson, S., & National Venture Association. (2013). American-made 2.0: How immigrant entrepreneurs continue to contribute to the US economy. Arlington, VA: National Foundation for American Policy.

· Azoulay, P., Jones, B. F., Kim, J. D., & Miranda, J. (2022). Immigration and entrepreneurship in the United States. American Economic Review: Insights, 4(1), 71-88.

· Growth Capital Advisory. (2022). The top 25 private equity firms of 2022. https://growthcapadvisory.com/the-top-25-private-equity-firms-of-2022/

· Gabrielsson, M., Kirpalani, V. M., Dimitratos, P., Solberg, C. A., & Zucchella, A. (2008). Born globals: Propositions to help advance the theory. International business review, 17(4), 385-401.

· Gaskell, A. (2021). What makes immigrants such good founders. Forbes. https://www.forbes.com/sites/adigaskell/2021/09/16/what-it-is-that-makes-immigrants-such-good-entrepreneurs/?sh=425c69805ed6

· Hernandez, E. (2019). Entrepreneurs pave the way for foreign VC investments. https://knowledge.wharton.upenn.edu/article/immigrant-entrepreneurs-pave-the-way-for-foreign-vc-investments/

· Ilya Strebulaev, Venture Capital Initiative, Stanford Graduate School of Business

· Kerr, S. P., and Kerr, W. R. (2020) “Immigrant Entrepreneurship in America: Evidence from the Survey of Business Owners, 2007 and 2012.” Research Policy. 49 (3): 1–18.

· Krol, R. (forthcoming) “Immigration and American Labor Market Outcomes.” Arlington, Va.: Mercatus Center at George Mason University, Working Paper.

· Tam, S. (2020). How immigrants drive entrepreneurship and innovation. Behavioral Scientists. https://behavioralscientist.org/how-immigrants-drive-entrepreneurship-invention-innovation/

· Vandor, P. (2021). Research: Why immigrants are more likely to become entrepreneurs. Harvard Business Review. https://hbr.org/2021/08/research-why-immigrants-are-more-likely-to-become-entrepreneurs

Additional Resources

· American Immigration Council. (2022). New American fortune 500 in 2022: The largest American companies and their immigration routes. https://data.americanimmigrationcouncil.org/en/fortune500-2022/

· Ganguli, I.; Kahn, S.; and MacGarvie, M. (2020) “Introduction.” In I. Ganguli, S. Kahn, and M. MacGarvie (eds.), The Roles of Immigrants and Foreign Students in U.S. Science, Innovation, and Entrepreneurship, 1–14. Chicago: University of Chicago Press.

· Murray, F., & Budden, P. (2017). A systematic MIT approach for assessing 'innovation-driven entrepreneurship' in ecosystems (iEcosystems). Working paper Published by MIT’s Laboratory for Innovation Science & Policy. Retrieved August 17, 2021, from https://innovation. mit. edu/assets/BuddenMurray_Assessing-iEcosystems-Working-Paper_FINAL. pdf.

· New American Economy. (2011). The “New American” fortune 500. https://www.newamericaneconomy.org/sites/all/themes/pnae/img/new-american-fortune-500-june-2011.pdf

· Pethokouksi, J. (2022). America’s greatest assets? The venture capital industry has to be near the top of the list. AEI. https://www.aei.org/economics/americas-greatest-economic-assets-the-venture-capital-industry-has-to-be-near-the-top-of-any-list/

Marc J. Sharpe is the founder and Chairman of TFOA, an organization formed in 2007 to provide a forum for education and networking and to serve as a resource for single family office principals and professionals to share ideas and best practices, pool buying power, leverage talent and conduct due diligence. Mr. Sharpe is active in the community and has served on the Board of the Holocaust Museum Houston, the HBS Houston Angels, and on the Investment Committee for two Texas based foundations.

TFOA is a peer network of Single Family Offices. Our community is intended to provide members with educational information and a forum in which to exchange information of mutual interest. TFOA does not participate in the offer, sale or distribution of any securities nor does it provide investment advice. Further, TFOA does not provide tax, legal or financial advice. Materials distributed by TFOA are provided for informational purposes only and shall not be construed to be a recommendation to buy or sell securities or a recommendation to retain the services of any investment adviser or other professional adviser. The identification or listing of products, services, links, or other information does not constitute or imply any warranty, endorsement, guaranty, sponsorship, affiliation, or recommendation by TFOA. Any investment decisions you may make based on any information provided by TFOA is your sole responsibility. The TFOA logo and all related product and service names, designs, and slogans are the trademarks or service marks of The Texas Family Office Association. All other product and service marks on materials provided by TFOA are the trademarks of their respective owners. All the intellectual property rights of TFOA or its contributors remain the property of TFOA or such contributor, as the case may be, such rights may be protected by United States and international laws and none of such rights are transferred to you as a result of such material appearing on the TFOA web site. The information presented by TFOA has been obtained by TFOA from sources it believes are reliable. However, TFOA does not guarantee the accuracy or completeness of any such information. All such information has been prepared and provided solely for general informational purposes and is not intended as user specific advice.