Private Debt Secondaries: Beyond GP/ LP Transactions into the World of Liquidity Management

By Marc J. Sharpe John Bohill, Kenneth McLaughlin, and Orla Walsh

As one of the fastest-growing areas of the private markets, the attractiveness of private debt as an asset class is broadly recognized. Its’ defined duration, low volatility, and limited drawdown risk relative to other alternatives is often desirable, particularly when considered with empirically stable returns.[1]As such, a natural evolution of a maturing primary market is developing volume in secondaries transactions.

Private debt secondaries (PDS) have prospered in recent years, providing liquidity to investors in a putatively illiquid asset class. Investment managers have responded—raising dedicated secondary funds and partnering with strategic players. In recent years, we have experienced the secondary market bloom from a nascent opaque market, focused initially on bilateral transactions and purchases of LP interests by private equity secondaries funds at steep discounts. Following Covid, the market transformed, and the associated dislocation has brought opportunities.

In 2022, substantial challenges in the liquid markets exacerbated the so-called denominator effect, leading institutional investors to be overweight several illiquid asset classes. Counterintuitively, the relatively strong performance of private debt meant that accepting a haircut on those valuations would require a comparatively modest markdown (particularly against devalued fixed income and equity holdings), and thus transactional volume arrived, reaching $17 billion in 2022 (more than 30x larger than 2012 levels), per Coller Capital.[2] Savvy family offices and other institutions became buyers of performing direct lending LP interests at prices reflective of private equity returns.

Relative “Haircuts” When Markets Head South

Secondaries volumes in 2022 were down across all asset classes, except for private debt, where volumes increased by 30.3%.[3] Investors utilized the secondary market for reasons varying from strategic redirection to rebalancing due to portfolio limitations and portfolio optimization. Investors sold private debt exposure because valuations remained stable relative to the public market (both debt and equity) and other private market asset classes.

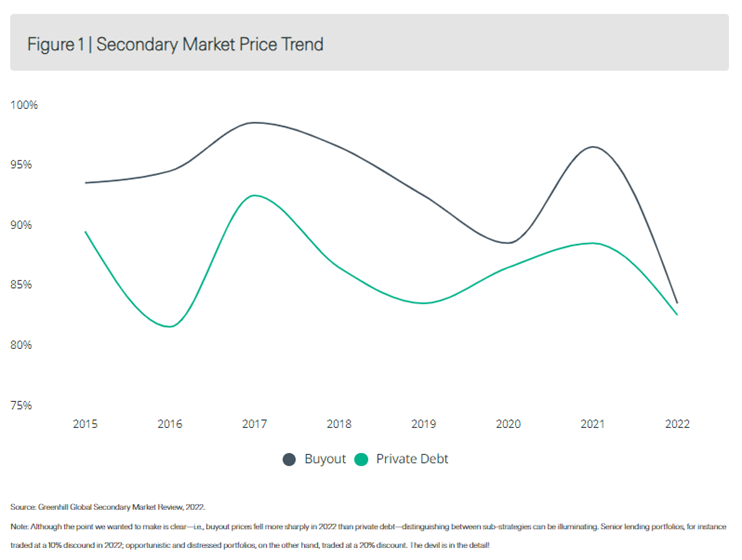

Figure 1 illustrates this point: The 2022 price decline in buyouts was more pronounced than in private debt. Notably, there is large price variance from the average prices listed below and the type of private debt strategy is influential to pricing; in 2022, senior lending funds priced in the low 90s, mezzanine strategies in the 80s and distressed/special sits in the high 70s. Compared with private equity discounts, which range from 15–25% during dislocations, private debt can offer an attractive alternative.

Discounts Matter, But Not as Much as One Would Think….

Price bands are important but insufficient to determine returns on their own. Consider that direct loans have an average economic life of 3 years (4 years in the current environment) [4]. Against a less liquid private equity portfolio, the distribution profile should be more condensed and predictable.

· Thus, price may vary greatly depending on the stage in the fund term and corresponding drawn and undrawn commitments, its current yield and any expected refinancings in the portfolio.

· In addition, historical loss rates must be considered and flexed for manager particulars such as concentration and industry exposure.

· Finally, transaction dynamics come into play, including approved buyer lists, speed of execution and any “stapled” primary investment requests attached to a current manager fund. There may be an amount of book building by the broker due to varying demand for specific funds and available ticket sizes.

This profusion of factors affects bid-ask spreads, but ultimately pricing is only one variable. In short, discounts matter but not as much as you might think!

PDS Market Formation

With a plethora of opportunities and an advantageous supply-demand imbalance, dedicated PDS investors stepped into the market in 2022, armed with lower cost of capital, the ability to apply portfolio leverage (at the investing entity), transaction leverage (through deferred payments), and alternative views on loss rates and cashflow modeling. For these investors, capital at work is as important as IRR and TVPI. Therefore, their desired outcome differs from your stereotypical private equity secondary buyers. So do their target returns: Over 50% of buyers seek a net IRR/TVPI below 12.5%/1.5x.[5]This market intervention is a positive secular change for existing private debt investors in need of liquidity.

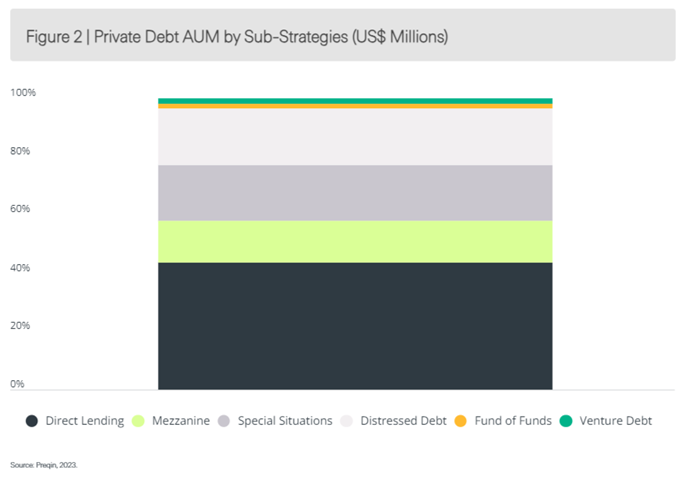

The term private debt covers an array of vastly different sub-strategies, some of which are covered in Figure 2. The market is in fact more disparate, with many more sub-strategies. Having broad coverage and asset class expertise is required to cover the universe.

Vetting broadly diversified direct lending portfolios requires in-depth market data and views on repayment speeds and expected loss rates. Conversely, concentrated distressed portfolios require familiarity with each company and line-item equity-style underwriting. The ability to accurately forecast returns across multiple strategies allows secondary buyers to provide broader and encompassing liquidity solutions. Market coverage is paramount.

Financial Innovation and Bespoke Liquidity Management Techniques

The PDS market may be in its infancy but innovative financing solutions from the private equity market are already being implemented.

· NAV-Financing is a broad term for financing underpinned by a diversified portfolio, which can contain private equity companies, real estate assets or even private debt funds. The portfolio’s NAV is used as collateral for the loan, generating liquidity for the GP or LP while retaining the future upside from the original portfolio exposure. Realizations in the underlying portfolio are used to fund the repayments of the NAV facility. This product is established in the private equity and real estate markets, but only recently adopted in the private debt secondary market as an alternative to secondary sales.

· Collateralized Fund Obligations (CFOs) have similar goals to secondaries, i.e., to enhance liquidity for GPs and LPs. CFOs are securities that create leveraged exposure to a portfolio of fund investments through the issuance of an equity tranche and one or more debt tranches. Think: CLOs with funds replacing the underlying loans.

For sellers, structured solutions may be preferable to a secondary sale in order to generate liquidity. Investors can maintain exposure to private debt while generating interim liquidity to rebalance their portfolios. Secondary investors are attracted to this investment style, as it meets the desired returns with a relatively attractive risk profile. With private equity secondaries, buyers and sellers often have differing views on the future valuations and potential upside of the assets. Since upside is relatively limited for private debt, differences of opinion tend to be narrower and more focused on repayment speeds and loss rates. When both parties’ views on future valuations are aligned, the variance in pricing is much lower and a structured solution which accommodates both parties’ requirements is often optimal.

PDS—The Flywheel Effect

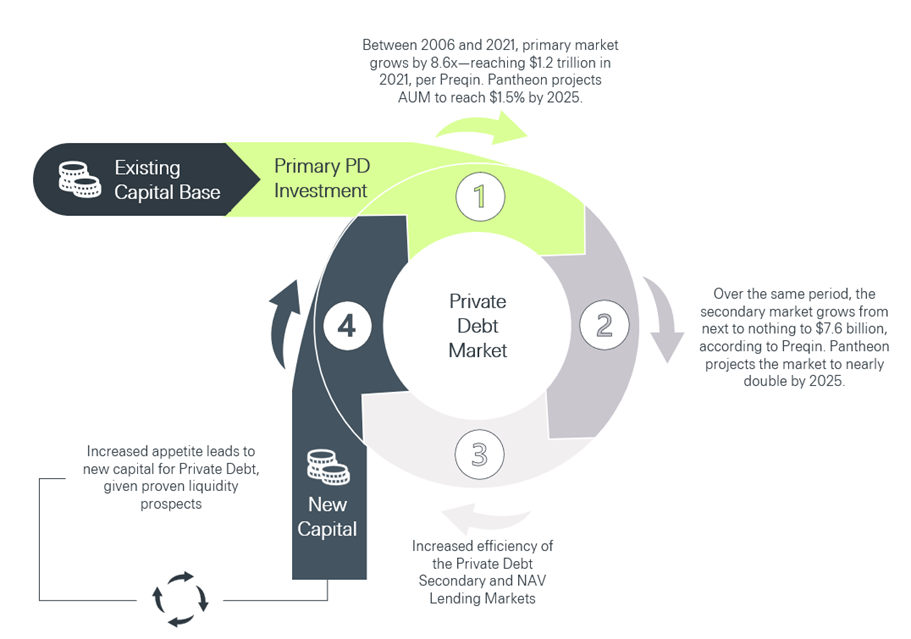

In 2022, private debt represented only 4% of the total secondary market.[6]As the asset class matures, we expect this share to expand. We suggest the continued growth and effectiveness of the private debt secondaries market will open private debt to a new investor cohort that previously had concerns about liquidity, term, or liability mismatches.

Conclusion

The private debt market is forecast to continue its growth due to its attractive yields throughout credit cycles, low volatility, limited drawdowns, and relatively high risk-adjusted returns. By that same token, volume in its secondary market is expected to increase. Family offices and institutional investors are supporting this growth in both the primary and secondary markets. We have observed LPs making tactical sales of relatively stable private debt portfolios, without exiting the private debt market entirely. We also observe several other important value drivers, in addition to discount emerging. Furthermore, activity has moved beyond traditional secondaries and into the more bespoke world of liquidity management through financial innovation.

By providing innovative liquidity solutions, Family offices and institutional investors are improving asset class accessibility to a new investor base. Now investors can confidently enter the private debt market and avail themselves of its illiquidity premium with the comfort that there will be liquidity if they seek to rebalance. Furthermore, due to the illiquidity of private debt and its corresponding valuations, investors can often transact at relatively attractive prices. As the PDS market matures, structured solutions will develop. Traditional secondary sales, while prevalent in the current market, may only cater to a certain investor group; investors in need of interim liquidity may prefer alternative financing solutions.

Disclosures

This document is for information purposes only and has been compiled with publicly available information. StepStone makes no guarantees of the accuracy of the information provided. This information is for the use of StepStone’s clients and contacts only. This report is only provided for informational purposes. This report may include information that is based, in part or in full, on assumptions, models and/or other analysis (not all of which may be described herein). StepStone makes no representation or warranty as to the reasonableness of such assumptions, models or analysis or the conclusions drawn. Any opinions expressed herein are current opinions as of the date hereof and are subject to change at any time. StepStone is not intending to provide investment, tax or other advice to you or any other party, and no information in this document is to be relied upon for the purpose of making or communicating investments or other decisions. Neither the information nor any opinion expressed in this report constitutes a solicitation, an offer, or a recommendation to buy, sell or dispose of any investment, to engage in any other transaction or to provide any investment advice or service.

Past performance is not a guarantee of future results. Actual results may vary.

On September 20, 2021, StepStone Group Inc. acquired Greenspring Associates, Inc. (“Greenspring”). Upon the completion of this acquisition, the management agreement of each Greenspring vehicle was assigned to StepStone Group LP. Each of StepStone Group LP, StepStone Group Real Assets LP, StepStone Group Real Estate LP and StepStone Group Private Wealth LLC is an investment adviser registered with the Securities and Exchange Commission (“SEC”). StepStone Group Europe LLP is authorized and regulated by the Financial Conduct Authority, firm reference number 551580. StepStone Group Europe Alternative Investments Limited (“SGEAIL”) is an SEC Registered Investment Advisor and an Alternative Investment Fund Manager authorized by the Central Bank of Ireland and Swiss Capital Alternative Investments AG (“SCAI”) is an SEC Exempt Reporting Adviser and is licensed in Switzerland as an Asset Manager for Collective Investment Schemes by the Swiss Financial Markets Authority FINMA. Such registrations do not imply a certain level of skill or training and no inference to the contrary should be made.

In relation to Switzerland only, this document may qualify as “advertising” in terms of Art. 68 of the Swiss Financial Services Act (FinSA). To the extent that financial instruments mentioned herein are offered to investors by SCAI, the prospectus/offering document and key information document (if applicable) of such financial instrument(s) can be obtained free of charge from SCAI or from the GP or investment manager of the relevant collective investment scheme(s). Further information about SCAI is available in the SCAI Information Booklet which is available from SCAI free of charge. Manager references herein are for illustrative purposes only and do not constitute investment recommendations.

StepStone Group Inc. (Nasdaq: STEP) is a global private markets investment firm focused on providing customized investment solutions and advisory, data and administrative services to its clients. StepStone partners with its clients, including sovereign wealth funds, insurance companies, prominent endowments, foundations, family offices and private wealth clients, to develop and build private markets portfolios designed to meet their specific objectives across the private equity, infrastructure, private debt and real estate asset classes. For more information visit stepstonegroup.com[MV1] .

Source: StepStone Group LP. The information contained herein is © 2023 by StepStone Group LP.

Disclosures

TFOA is a peer network of Single Family Offices. Our community is intended to provide members with educational information and a forum in which to exchange information of mutual interest. TFOA does not participate in the offer, sale or distribution of any securities nor does it provide investment advice. Further, TFOA does not provide tax, legal or financial advice. Materials distributed by TFOA are provided for informational purposes only and shall not be construed to be a recommendation to buy or sell securities or a recommendation to retain the services of any investment adviser or other professional adviser. The identification or listing of products, services, links, or other information does not constitute or imply any warranty, endorsement, guaranty, sponsorship, affiliation, or recommendation by TFOA. Any investment decisions you may make based on any information provided by TFOA is your sole responsibility. The TFOA logo and all related product and service names, designs, and slogans are the trademarks or service marks of The Texas Family Office Association. All other product and service marks on materials provided by TFOA are the trademarks of their respective owners. All of the intellectual property rights of TFOA or its contributors remain the property of TFOA or such contributor, as the case may be, such rights may be protected by United States and international laws and none of such rights are transferred to you as a result of such material appearing on the TFOA web site. The information presented by TFOA has been obtained by TFOA from sources it believes are reliable. However, TFOA does not guarantee the accuracy or completeness of any such information. All such information has been prepared and provided solely for general informational purposes and is not intended as user specific advice.

The Family Office Association (“TFOA”) is a global peer network that serves as the world’s leading single family office community. Our group is for education, networking, selective co-investment, and a resource for single family offices to share ideas, deal flow and best practices. Members are not actively marketing products or services to other members and no contact information or email lists will ever be shared. Since our founding in 2007, TFOA has led the global single family office community by delivering world-class educational content, unique networking opportunities, and exceptional thought leadership to our highly curated network of the world’s largest and wealthiest families.

Marc J. Sharpe is the founder and Chairman of TFOA, an organization formed in 2007 to provide a forum for education and networking and to serve as a resource for single family office principals and professionals to share ideas and best practices, pool buying power, leverage talent and conduct due diligence. Mr. Sharpe also teaches an MBA class on “The Entrepreneurial Family Office” as an Adjunct Professor at SMU Cox School of Business: Contact: marc@tfoatx.com

[1] StepStone Group. 2023. “Relative Attractiveness of Direct Lending: Liquidity, Volatility and Drawdowns.”

[2] Claire Coe Smith. 2023. “Private Debt Secondaries: Macro disruption generates momentum,” Private Debt Investor, 2 May.

[3] Setter Capital. 2022. “Volume Report FY 2022.”

[4] Cliffwater. 2023. “2022 Q4 Report on U.S. Direct Lending”

[5] Campbell Luytens. 2022. “Secondary Market Overview.”

[6] Campbell Luytens. 2022. “Secondary Market Overview.”